The 6-Second Trick For Hard Money Atlanta

Facts About Hard Money Atlanta Uncovered

Table of ContentsHard Money Atlanta Fundamentals ExplainedHow Hard Money Atlanta can Save You Time, Stress, and Money.The Basic Principles Of Hard Money Atlanta The 5-Minute Rule for Hard Money AtlantaHard Money Atlanta - An Overview

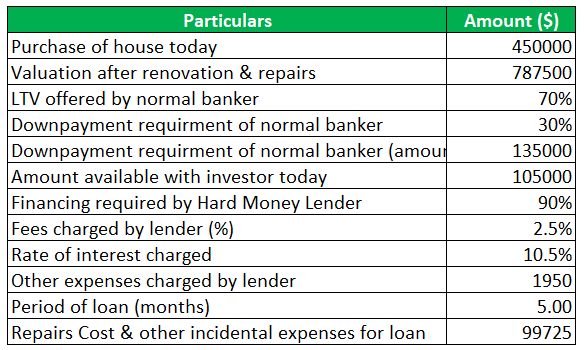

, are temporary lending tools that genuine estate financiers can use to finance a financial investment task.There are 2 key downsides to take into consideration: Hard money finances are hassle-free, yet financiers pay a rate for obtaining by doing this. The price can be as much as 10 percentage points greater than for a standard funding. Source costs, loan-servicing charges, and also shutting expenses are also most likely to set you back investors much more.

Getting My Hard Money Atlanta To Work

You might be able to customize the payment schedule to your demands or obtain specific fees, such as the origination fee, minimized or gotten rid of throughout the underwriting process. With a hard money funding, the residential property itself normally acts as security for the lending. Again, loan providers may enable investors a little bit of leeway right here.

Hard cash lendings are an excellent fit for well-off capitalists who require to get funding for a financial investment residential property quickly, with no of the bureaucracy that supports bank funding (hard money atlanta). When evaluating difficult cash lenders, pay very close attention to the charges, passion rates, and car loan terms. If you wind up paying excessive for a difficult money loan or cut the settlement duration too short, that can influence how profitable your property venture is in the long term.

If you're aiming to buy a residence to flip or as a rental building, it can be testing to obtain a traditional home loan - hard money atlanta. If your credit rating score isn't where a typical lending institution would like it or you need cash money more rapidly than a loan provider is able to supply it, you can be unfortunate.

The Greatest Guide To Hard Money Atlanta

Tough cash financings are short-term protected fundings that make use of the residential property you're purchasing as security. You won't locate one from your bank: Hard cash fundings are provided by alternate loan providers such as individual financiers as well as exclusive companies, that normally forget average credit rating ratings as well as various other economic factors and also rather base their decision on the building to be collateralized.

Difficult cash lendings supply several advantages for customers. These include: From start to finish, a tough cash finance might take just a couple of days.

While difficult cash finances come with advantages, a borrower must likewise take into consideration the risks. Amongst them are: Hard cash loan providers usually bill a greater passion rate because they're assuming more danger than a traditional lender would certainly.

Little Known Facts About Hard Money Atlanta.

Every one of that amounts to imply that a hard money financing can be a costly means to borrow cash. hard money atlanta. Deciding whether to get a difficult cash finance depends in huge component on your scenario. All the same, make certain you evaluate the threats as well as the costs before you join the dotted line for a difficult money loan.

You definitely do not wish to shed the lending's collateral because you weren't able to stay up to date with the monthly repayments. Along with shedding the property you put onward as collateral, back-pedaling a difficult money financing can lead to major credit history harm. Both of these results will leave you even worse off economically than you remained in the first placeand may make it a lot harder to borrow once more.

Everything about Hard Money Atlanta

It is very important to consider factors such as the lending institution's online reputation and also rates of interest. You could ask a trusted property click to investigate agent or a fellow house flipper for suggestions. When you have actually pin down the appropriate tough money lending institution, be prepared to: Come up with the deposit, which normally is heftier than the deposit for a conventional mortgage Collect the required documents, such as proof of income Possibly employ a lawyer to review the terms of the car loan after you have actually been approved Draw up a method for paying off the lending Equally as with any kind of finance, assess the benefits and drawbacks of a difficult cash funding prior to you devote to borrowing.

No matter what type of lending you choose, it's possibly a good suggestion to inspect your complimentary credit history and also helpful site complimentary credit rating report with Experian to see where your financial resources stand.

When you hear the words "hard cash finance" (or "personal money funding") what's the initial point that goes with your mind? Shady-looking lending institutions that conduct their service in dark alleys as well as fee sky-high interest prices? In previous years, useful reference some poor apples stained the tough money lending market when a couple of aggressive lenders were attempting to "loan-to-own", giving very risky finances to debtors making use of actual estate as security and intending to seize on the properties.